Managing positive financial health for an organisation is the most important task

Our solution ensures a significant improvement in financial performance within a short span of time.

Every organization faces a lot of challenges in converting the receivables into cash. Corporates have receivable turnover all the time high and indirectly corporates are extending “interest free loan” to their clients since accounts receivables are money owned without interest.

For resolving such issues, we have developed “IntelCredit” which is a Smart Credit management software system, designed considering the challenges faced by the Corporates such as Increased Receivables Aging, Poor management of credit risks leading to Bad Debts, unintended repeat businesses for defaulters and lack of accountability.

Core consideration factors

We have developed “IntelCredit,” a Smart Credit Management Software system, crafted to tackle the challenges faced by corporations including increased receivables aging, poor management of credit risks leading to bad debts, unintentional repeat business from defaulters, and a lack of accountability. Our solution promises a marked improvement in financial performance within a short span of time. To ensure maximum utilization of IntelCredit and to achieve the expected ROI for our partners, it is crucial to uphold the foundational pillars of our approach.

Furthermore, IntelCredit leverages advanced analytics to predict future payment behaviors and optimize credit limits dynamically. It integrates seamlessly with existing Oracle ERP system, enhancing transparency and enabling real-time decision-making. By automating credit processes, our software not only minimizes human error but also frees up valuable resources, allowing your team to focus on strategic initiatives rather than routine management. With IntelCredit, your business is equipped to handle the evolving landscape of credit management effectively and efficiently.

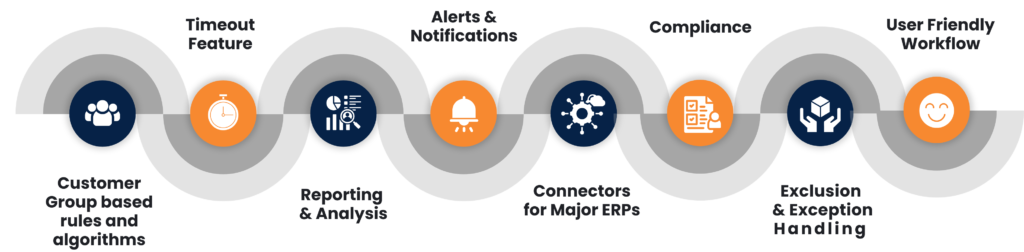

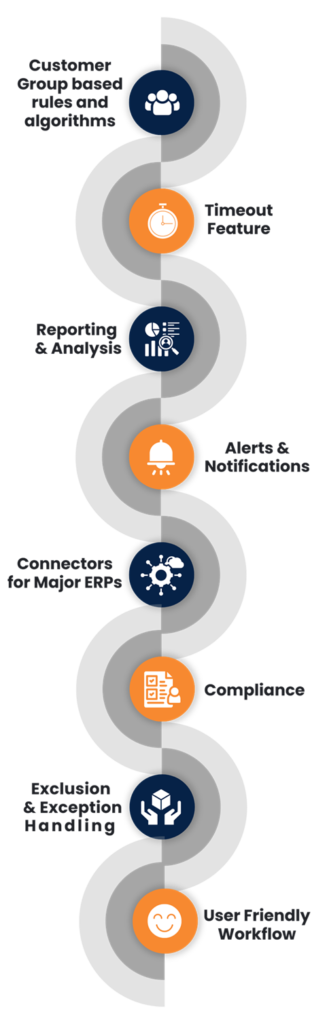

Salient Features

Lorem ipsum dolor sit amet, consectetur adipisicing elit. Sint ipsa voluptatibus, voluptates consequuntur quam nisi.

Key Benefits

- Increased Cashflow: Optimize your cash flow with IntelCredit’s streamlined credit management processes, facilitating faster invoice processing and payment collections.

- Reduced Receivables Aging: Keep your receivables in check with IntelCredit’s proactive monitoring and automated reminders, reducing aging and improving cash flow.

- Decreased Bad Debts: Mitigate the risk of bad debts with IntelCredit’s advanced credit risk assessment capabilities, ensuring smarter credit decisions and minimizing losses.

- Compliance Audit Enabled: Stay compliant with regulatory requirements effortlessly with IntelCredit’s robust audit trail and compliance reporting features.

- Easy Performance Evaluation: Effortlessly evaluate your credit management performance with IntelCredit’s reports.

- Increase Accountability: Enhance accountability across your organization with IntelCredit’s transparent credit management processes and correct decision making.